Maeil is developing organic Milk drinks for infants and kids. Calculate cost of capital for this product

1. Milk

industry beta

In order to find the overall milk

industry beta, we construct the dataset which is consisted of various levered

industry beta.

In order to standardize the levered beta

to unlevered beta, we use the unlevered-levered equation as follows and

re-arranged the data. Related information are as follows.

<Equation>

Where

Bu

= Unlevered beta

BL

= Levered beta

Tc

= Marginal corporate income tax rate

D/E

= Debt to equity ratio

<Data

sets>

So,

we construct the equation to find the beta for milk industry as follows

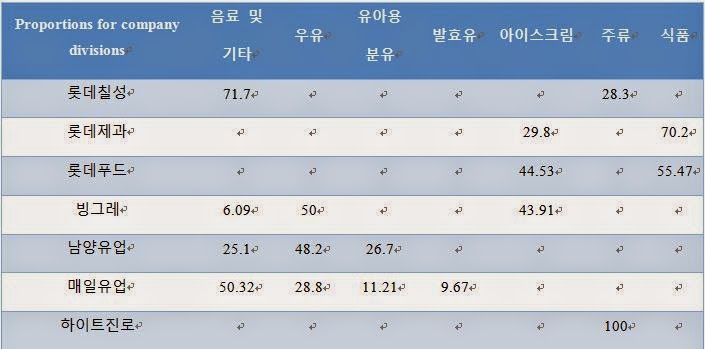

Where {a: 음료

및 기타,

b: 우유, c: 유아용

분유, d: 발효유,

e: 아이스크림, f: 주류

, g: 식품}

By solving the equation, the daily 1 year beta

for the milk industry which is unlevered is 1.3.

Also, the monthly 5 years beta for the milk industry

which is unlevered is -0.3. We will use the average of these two betas, 0.5

2. Beta

for organic milk drink for infants and kids

Organic

milk is introduced to the market in 2008. But these days, with well-being

environment, this category had grown and now it accounts for 6% in overall milk

market. Basically this organic milk drink is targeting for infants and kids.

So, we do not distinguish the organic milk drink for infants and adults. Maeil

is now producing this organic milk drink in Sangha factory.

In

order to calculate the beta for organic milk drink for infants and kids, we

divide the milk industry as organic and non-organic milk market. We used Maeil

and Namyang`s levered milk industry beta. Weights for each divisions are

calculated by comparing sales proportions.

<Equation>

Where

a

= traditional, non-organic milk beta.

b= organic milk beta.

<Solutions>

∴

Beta for organic milk drink for infants

and kids : 4.8 (Levered for Maeil)

3. Expected

returns for stock using CAPM model.

In

order to calculate the E(Rs), average KOSPI in 2001 to 2014 is used. Also, 20

years T-bond YTM for risk free return.

<Equation>

E(Rorganic milk industry) = E(Rf) + Borganic milk industry(E(Rm)-E(Rf))

Where

E(Rf)

= 4.70

E(Rm)

= 15.51

Borganic milk industry = 4.8

∴

Expected returns for organic milk drink

for infants and kids : 56.588

4. Expected

returns for debt and debt to equity ratios.

According to the 2013 Maeil business report, their

company bond is rated as AA-. And the industry rate for AA- which is the 1 year

maturity is 2.865. And the marginal corporate income tax rate for Maeil is 22%.

Maeil is not released any preferred stocks.

Number

of stocks Maeil released is 12,731,566. And the price for each stock is ₩44,800 in

December 30, 2013. Total debt except non-initiating interest rate debt is ₩130,585,861,627. Price to book ratio is 1.3487

So weighted average for stock is 76% and seighted average for debt is 24%.

5. WACC

for organic milk drink for infants and kids

<Equation>

WACC = 0.76 * 56.588 + 0.24 * 2.865 = 43.7%

댓글

댓글 쓰기